Leasing Season Update: Operators Start Strong Despite Headwinds

Despite some economic clouds on the horizon, this year’s moving season is off to a strong start for the self-storage industry.

Inflation has helped drive self-storage rents to record levels. Supply and demand is also driving pricing. New supply is muted with many developers stepping back from projects as costs climb. On the demand side, unemployment remains at historically low levels as the country saw 390,000 new payroll jobs created in May.

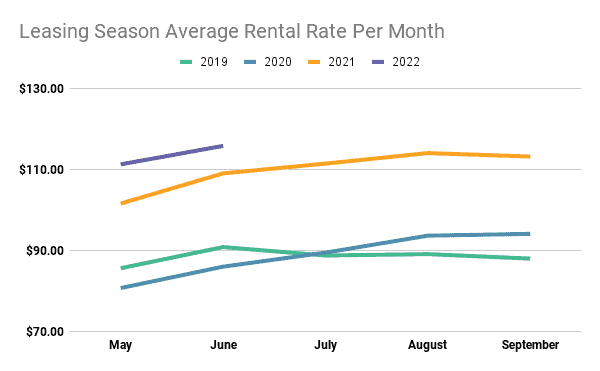

Record rates

Operators continue to build off the post-pandemic surge of last year, pushing rates to new heights. The average price for all storage units rented on the SpareFoot.com platform in June was $115.88. That is a 6.2% increase over the previous year and 34% more than June 2020.

May was similarly impressive. With an average rental rate of $111.31, operators increased rents by 9.5% from May 2021 and 37.9% from May 2020.

If we let history serve as a guide, the self-storage industry can expect rates to climb even higher as the moving season progresses. Last year, moving season rates increased 12.2% from May to their peak in August. In 2020, prices moved 16.6% from May and the peak in September. Based on that record, the industry could potentially command rates between $122 and $129 per month average for all units by the end of the leasing season.

However, inflation continues to outpace wage growth and consumer spending on goods and services is trending downward as Americans look for ways to cut back. How those trends continue to play out could have a limiting effect on operators’ ability to push rates further in the short-term.

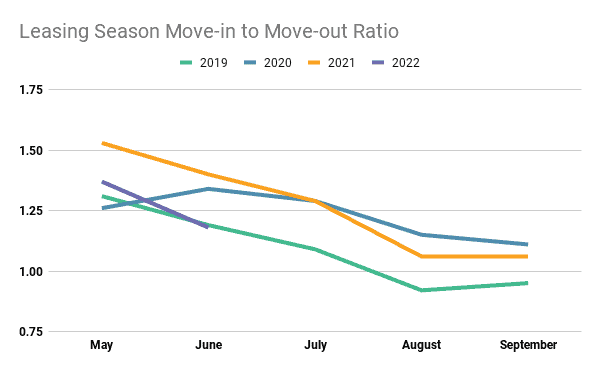

Maintaining healthy churn

As street rates have risen, self-storage operators have been able to increase rates on existing tenants as well. Typically any customers that move-out due to a price increase are replaced by new customers who are willing to pay the new prevailing rate.

That remains true so far this moving season, but at the onset, operators are attracting slightly fewer new tenants for every tenant that moves out. Storable data found that the self-storage industry had 11% fewer move-ins in May compared to the previous year. That is not so surprising, considering that 2021 saw a surge in pent up demand following the lockdowns of 2020, so the decline doesn’t represent a cause for concern.

Move-outs have also declined so far compared to last year, but at a slower rate of 1.3% year-over-year in May. That resulted in a move-in to move-out ratio of 1.37, which represents 1.37 new tenants for every tenant lost. Compare that to 1.53 in May of 2021, during the post-pandemic surge.

Move-outs typically rise over the course of the summer season, peaking in August as students return to school from break. This usually results in more move-outs than move-ins by the end of summer. But this didn’t happen in 2020 because of the pandemic, and in 2021 it didn’t happen either because of pent-up demand. The trend could repeat itself this year, but based on the average change in the MI/MO ratio over the last few leasing seasons, a one-to-one ratio is the most likely outcome.

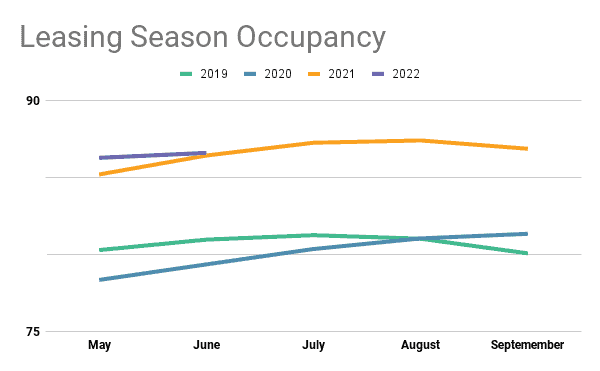

Occupancy holds strong

Storable data shows self-storage operators had an average occupancy in May that was 1.26% higher than the same time last year, and 10% greater than 2020.

Looking at the last two years, occupancy climbed between 3% to 4% from the start of the moving season through the peak. Operators reached peak occupancy in September of 2020, but peaked in August last year. As the summer leasing season progresses, we’d expect a similar trend in occupancy to play out this year as well.

A look ahead

If all the above trends hold as expected, the self-storage industry will end the summer leasing season with record high occupancy and record high rental rates. That is not a bad position to be in as the economic indicators point to increased odds of a recession in coming months.

One way to take advantage of leasing season trends is with data-driven revenue management tools built into Storable facility management software. These features enable you to automatically optimize rates and boost NOI. Take a look under the hood and learn more about what Storable software can do.

Lock-It-Up Self Storage Modernizes Operations and Reduces Costs with storEDGE

Lock It Up Self Storage, an Ohio-based company with 17 locations, has been a trusted name in their local market for over 30 years. In their commitment to provide best-in-class service, Lock It Up recognized the need to modernize their operations to meet evolving customer expectations. Keep Reading

Why a Connected Website & Software Experience is Key to Reducing Errors and Improving Operations

By investing in integration, you’re not just saving time and preventing errors—you’re positioning your business as a trusted, professional operation that stands out from the competition. Keep Reading

How StoreEase Streamlined Facility Transitions and Scaled Operations with Storable

After evaluating multiple platforms in 2024, StoreEase deepened their partnership with Storable, citing our seamless onboarding process, project visibility, and streamlined data migration capabilities. Keep Reading