Fueled by a pandemic-driven surge in demand, the self-storage industry has recently enjoyed record high rents and occupancy rates. But with the most recent leasing season in the rearview, it appears that fundamentals are returning to more familiar patterns of seasonality.

Over the last few years, self-storage operators have made huge gains when it comes to rent and occupancy:

- The average leasing season occupancy has grown 6.8% since 2019.

- The average monthly rental rate has risen more than 28% since 2019.

However, data from the most recent leasing season shows us that the period of outsized gains has come to an end as the economy enters a new phase.

To help operators understand the recent changes in demand and how they might navigate them going forward, we’ve compiled industry data from Storable for the last four leasing seasons. For the purpose of this analysis we defined the leasing season as May through September.

Keep reading to learn more about the key changes we observed over the course of the most recent leasing season.

The return of churn

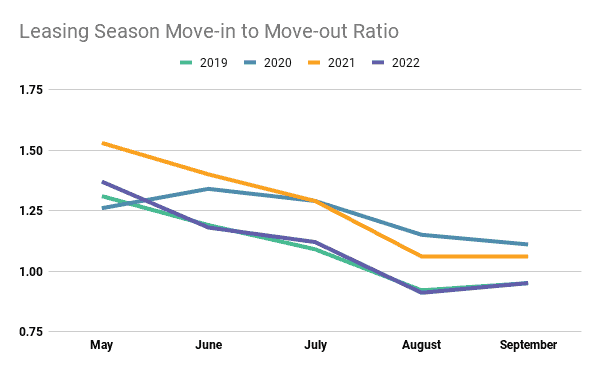

The self-storage industry saw slightly more move-outs than move-ins in August and September. That’s what typically happens in a normal year as student renters and other seasonal tenants move out in the fall. In 2020 and 2021, however, the industry bucked this trend and experienced more move-ins than move-outs throughout the entire leasing season. For much of that time, move-out activity was limited by COVID-19 restrictions.

Looking at the average move-in / move-out ratio during the last four leasing seasons (May-September), you can see the “pandemic bump” in action:

- 2019: 1.09 M/M ratio

- 2020: 1.23 M/M ratio

- 2021: 1.27 M/M ratio

- 2022: 1.11 M/M ratio

This is further demonstrated in the chart below, where you can see how the trend line for the 2022 leasing season is almost identical to the one in 2019:

Now that most COVID-related restrictions have been lifted, the recent leasing season saw an acceleration in move-outs compared to the previous year. It also experienced a decrease in the number of move-ins. The return of this trend shouldn’t be a major cause for concern, but rather an indication that the surge in demand generated by the pandemic has largely subsided and operators should adjust their marketing strategies accordingly.

Occupancy pulls back

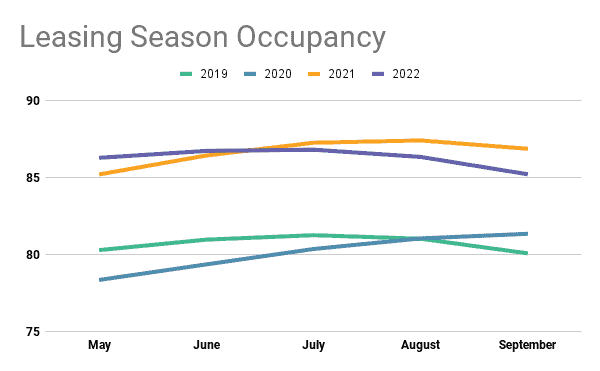

Storable data found that industry occupancy rates fell during the leasing season for the first time since 2019. Average occupancy in September ended up 1.1% lower compared to the start of the busy rental season in May.

Contrast that to the previous two years when operators ended the leasing season with occupancies on average more than 2% higher than they started out with.

More takeaways:

- From 2021 to 2022, average occupancy began to decline on a month-to-month basis starting in July and accelerating through September.

- Average occupancy in September 2022 fell 1.9% compared to September 2021.

- Overall operators retain much of the occupancy gains they made during the pandemic, with average occupancy for the entire leasing season 6.9% higher than the leasing season in 2019.

Storable CEO Chuck Gordon pointed out during a recent webinar that occupancy was down across all U.S. regions in August.

“Obviously we’re not the only ones noticing these trends, because operators have begun lowering their prices in response,” Gordon said.

Indeed, rental rates also declined in the month of August for the first time since 2019.

Rates take a turn

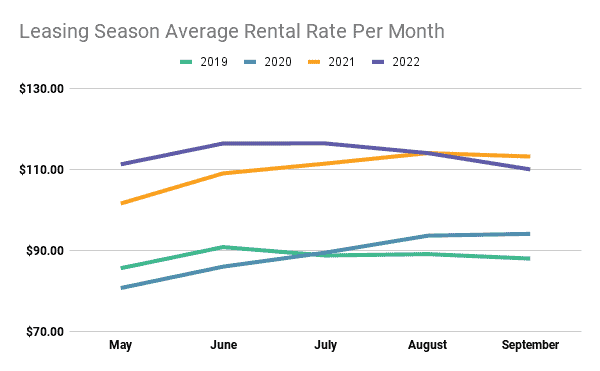

Rental rates reached a new peak in July with a record high average of $116.49. But rates declined from there in August, dropping even further in September.

As you can see from the chart below, the decline in prices that occurred at the end of the season was much sharper than the decline in 2019. In fact, this leasing season ended with average rates 1% lower than where they stood at the start of the busy rental season in May.

Compare that to the leasing season last year when rates grew more than 11% from May to September.

More takeaways:

- The average monthly rental rate for the leasing season was $113.69.

- That represents a 28% increase in the average rate since 2019.

- Rental rates peaked in July 2022 at $116.49/month.

- Average rates dropped more than 5.5% over the following two months, ending the leasing season with an average of $110.07 in September.

The drop in prices that started in August can largely be attributed to a pull back in occupancy as discussed previously. In addition, operators may have not raised rates as aggressively as they had last year due to the increase in churn.

“Operators are starting to lower prices earlier than they normally do this year. This phenomenon combined with the accelerated pace of move outs, means that many tenants will be replaced by lower rent tenants, which will put a drag on revenue,” Gordon said.

Conclusion

As the pandemic driven demand has faded away, seasonality has returned to the self-storage industry. The good news for storage operators is that the amount of growth that occurred during the COVID-19 crisis has put the industry in a strong position as they prepare to face new challenges.

The new challenges, however, could be quite significant. The decline in prices and occupancy that took place during the recent leasing season indicate a softening of demand, which is being impacted by growing uncertainty over the future of the economy and consumers holding off on making major life transitions as a result. Interest rate hikes at the Fed are having a chilling effect on job growth and the housing market, two key demand drivers for the self-storage industry.

It is expected that occupancy and rates will continue to decline through the winter, putting downward pressure on operating revenue for self-storage operators. Only time will tell how deep those declines will be and how much of the pandemic-era gains operators will be able to hold on to if the economy takes a major downturn.

“We believe the operators who will be most successful in this environment are those that focus on efficiency-based cost savings and creative ways to expand revenue per tenant,” Gordon said.

To learn more about these trends check out Chuck’s recent webinar, and subscribe to our new Unpacked newsletter to take a monthly deep dive into the latest industry trends and innovation from Storable.