Self-storage development hits pause after record year for spending

Self-storage development hits pause after record year for spending

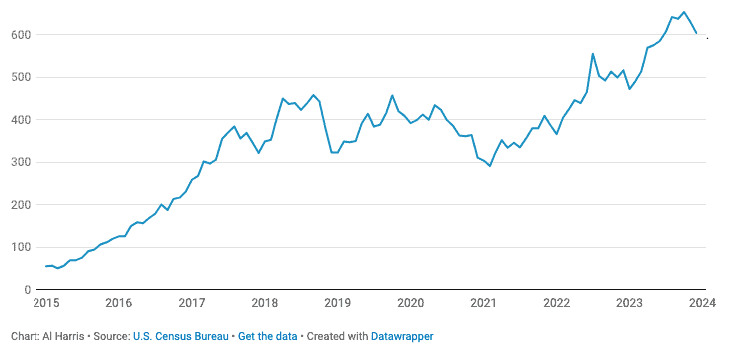

Construction spending in the self-storage sector topped $6.9 billion in 2023 as developers moved through a development pipeline that expanded after the COVID-19 pandemic.

According to U.S. Census Bureau statistics, last year’s spending marked a 24% increase over 2022, with $5.6 billion spent building or expanding self-storage facilities. The sector spent an average of $4.4 billion on construction per year from 2019 to 2021.

Self-Storage Construction Spending by Month

Figures in millions of dollars

The pandemic and its associated impact on migration patterns and work-from-home trends led to a surge of demand for self-storage space in recent years. Average rents and occupancy for storage units soared to record levels, and developers rushed into the space to build new inventory.

However, recent industry data suggests that the sector has reached a turning point. Analysts anticipate reducing deliveries of newly built self-storage space beginning in 2025. One reason for the change in outlook is a sharp rise in deferred and abandoned self-storage projects across the country.

Expand and contract

The industry is undergoing a near-term supply expansion as the wave of projects initiated in recent years come to completion. The last quarter of 2023 also saw an increase in new construction projects, leading analysts to raise projections for new self-storage space expected to open in 2024 and 2025. Experts predict the industry will deliver 54.5 million square feet of self-storage space this year, and 47.9 million in 2025.

However, looking further ahead, long-term projections for self-storage deliveries in 2026 through 2029 have been reduced. Annual completions are expected to fall to just over 29 million square feet at the decade’s close.

Abandon ship?

What data points portend this decline in self-storage development activity? Industry analysts noted a marked rise in stalled projects during the year’s second half.

The downward trend in rates may have rendered some planned projects no longer viable, leading investors to cancel them. In 2023, 245 planned storage developments were canceled. According to industry data, the number of deferred projects grew 44.5 percent annually, and the number of abandoned storage properties increased by 104.2 percent compared to 2022.

A noticeable slowdown

Marc Boorstein, principal of MJ Partners self-storage advisory, said the chill in self-storage development is mostly driven by two interrelated factors: falling move-in rates and a challenging lending environment for commercial real estate.

Boorstein’s firm advises about 30 developers nationwide—representing about half of the total activity in major markets. While typically, each would have several projects in the works right now, many are down to a single project if they have any at all.

“The construction lending environment is so difficult,” Boorstein said, “It is really slowing down new activity.”

The number of storage completions nationwide is projected to fall from 500 and 600 in the past few years to around 400 this year and trending lower for next year’s new deliveries. Boorstein said major lenders are generally skittish on commercial real estate loans, with smaller regional lenders picking up some of the slack. But Boorstein said even then, regional lenders are scrutinizing deals more than ever, and the interest rates are higher. That’s caused developers to press pause and wait for the market conditions to improve.

Boorstein added that the slowdown should be a real positive for existing facilities, which will have less new competition to deal with as they try to grow rates.

Falling rates

A lack of rental rate growth in the storage sector has made it difficult for new projects to get funded.

“Last spring and summer, there wasn’t a big pop in rental activity,” Boorstein said, “The developers and lenders look at the move-in rates, and they are lower than they were last year.”

Another factor pulling down storage rents is the steep discounting the REITs offer at move-in, particularly Extra Space Storage, whose acquisition of 1,200 Life Storage facilities made it the largest operator in the industry. The strategy of offering low introductory rates has proved effective in gleaning market share from private operators. The public operators have been able to raise customer rates later in their tenancy while retaining high occupancy levels exceeding 90%.

Boorstein noted that private operators are following suit, with third-party management companies slashing rates for properties in lease-up to fill them quickly.

“They are finding a lot of success, some increasing rates much quicker than anticipated, after three or four months instead of six months or a year,” Boorstein said.

Wait and see

But for lenders, it is difficult to underwrite a new development when lease up is at a lower rate, Boorstein added.

Looking at last year’s results, Boorstein said the assumption is that rent growth will be minimal during the first half of the year and that it could accelerate in the second half if the residential housing market opens up.

“If all of a sudden the home market picks up really strong, the self-storage development will pick up fast,” Boorstein said.

Webinar: Expert Insights – What’s Next for Self-Storage in 2025

From adapting to market shifts to leveraging technology, our panelists provide a behind-the-scenes look at what they’re doing to stay ahead in the new year. Keep Reading

Storage Monitor: Self-storage firms strike gold on their rooftops with lucrative ‘community solar’ deals

A growing number of commercial and industrial property owners are eyeing on-site solar installations in general to help offset high utility bills, particularly heavy electricity users such as manufacturers and tech firms with huge data centers. Keep Reading

Storage Monitor: Los Angeles Self-Storage Market Trends Report

Aggregated industry occupancy climbed 1.23% since March. That’s an improvement over last year’s weak busy season when occupancy only grew 79 basis points during the five-month period between April and August. Keep Reading