Los Angeles stands out as one of the country’s most competitive self-storage markets, and the most expensive.

The City of Los Angeles is home to an estimated 3.82 million residents. Los Angeles County, which includes the city population, is even larger, with a total of 9.6 million people.

With many people living in smaller apartments or homes, there is limited space for personal belongings, driving demand for storage solutions. Additionally, the city’s transient population, including students, professionals, and seasonal residents, often require temporary storage during moves or transitions. The high cost of real estate also encourages businesses to use storage facilities as a cost-effective alternative to renting larger commercial spaces. These factors create a consistent and growing demand for self-storage in the Los Angeles area.

Los Angeles Self-Storage Trends

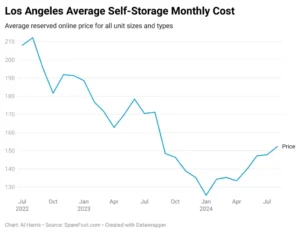

The Los Angeles self-storage market is one of the most expensive in the country, with an average monthly rental rate of $138.72, or $2.02 per square foot, so far in 2024.

The average price of a self-storage unit in Los Angeles in August was $152.33, the highest monthly average in 2024, marking continued rate growth over the course of the summer busy season. While rates have grown steadily since spring, average storage rent in Los Angeles are down about 18.9% compared to this month last year.

Why are storage prices in Los Angeles declining?

As people moved away from cities and cleared out space for home offices, the COVID-19 pandemic created a mass surge in demand for local self-storage space. This led to fast growing prices as occupancy hit record high levels. The surge in pricing peaked in 2022, followed by a period of rapidly cooling demand as the impacts of the pandemic subsided. At the same time the real estate market had slowed rapidly as interest rate increases and inflation impacted housing affordability. As more Angelinos stayed put in their existing residences and would-be homebuyers were sidelined, operators dropped prices and increased promotions to fill their empty storage units—driving down market prices.

Now the price declines appear to be stabilizing as storage operators have successfully increased rates over the course of the current moving season. As the home buying market warms up it is expected that self-storage demand will increase and provide fuel for further growth in average self-storage rates.

Los Angeles Moving Trends

While the metropolis remains a major draw for people seeking their big shot and sun-soaked fun, the city and county are actually shedding residents. The city population is estimated to have declined about 2% since 2020, and the county population has fallen by 3.5%.

The decline in population in L.A. mirrors an overall decline in population statewide. Statewide declines in population are attributed to excess deaths from the pandemic, declining birth rates, and stricter immigration policies. In Los Angeles, departures are accelerated by high housing costs pushing inhabitants out to find more affordable digs and lower cost of living in other locales.

Average Self-Storage Price by Unit Size in Los Angeles

Ranging from small 5×5 storage units treasured by college students or large 10×30 units that can contain an RV, L.A. storage units come in many sizes. Below are average prices for the year to date by unit size:

Climate Controlled Self-Storage Costs in Los Angeles

Los Angeles is famous for its warm and breezy Mediterranean climate, but climate change is making summers hotter. L.A.s triple-digit heat waves can damage items stored improperly, making climate-controlled storage a popular premium amenity throughout the region.

Below is a comparison of climate-controlled vs non-climate controlled storage units for the most recent month of available data for various markets in the L.A. metropolitan area. As you can see, the cost of climate-controlled storage units is typically more expensive than units without climate control.

However, Los Angeles appears to be an anomaly with non-climate controlled self-storage units coming in about 33% more expensive than climate controlled units. Various additional factors can affect the pricing of self-storage units including location, amenities, and unit availability at the facility level. The amount of newly developed self-storage space that is in the “lease up” phase can also affect pricing. During the lease up phase operators may offer space at below market rates in order to gain occupancy. Over the last couple years, Los Angeles has witnessed the development of many new self-storage facilities. This increase in the supply of climate-controlled self-storage units in lease up may be one reason for this pricing dynamic.

Changes Ahead

The SpareFoot Storage Beat will continue to keep track of the latest changes in the Los Angeles self-storage. Bookmark this page and check for future updates throughout the year to keep abreast of the latest data available about the Los Angeles self-storage market, or sign up for our weekly email full of the latest self-storage industry news.