Let the busy season begin.

Self-storage operators have patiently faced months of price and occupancy declines since the peak of activity last summer. Now they get the chance to regain some of that pricing power as seasonal demand kicks into drive.

But with a somewhat sluggish and uncertain economic environment, it remains to be seen how big of a demand curve the industry will see ahead. With April in the rearview, we have a baseline from which we can observe how the industry fares over the next few months. Let’s take a look:

Pricing

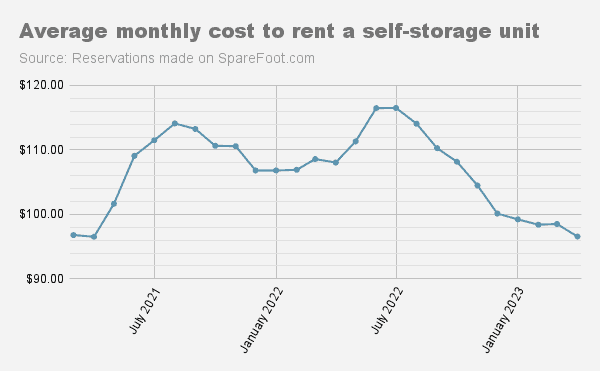

The average price to rent a self-storage unit in the United States was $96.65 a month in April, down more than 10% from the same month a year ago. Prices are expected to rise through the summer months, but it is unlikely that rates will reach the record levels hit last year.

One headwind limiting demand is a tight housing market with sky-high interest rates and a lack of inventory. Sales activity is expected to fall below last year’s levels.

Prices in April were down 1.9% from March. Prices typically dip slightly in April in advance of the summer surge in demand and accompanying rate growth, but the current decline is more significant than in years past. Storage rates have declined month to month since September of last year, with the exception of March.

| September 2022 | $110.27 | -3.44% |

| October 2022 | $108.16 | -1.95% |

| November 2022 | $104.49 | -3.51% |

| December 2022 | $100.13 | -4.35% |

| January 2023 | $99.22 | -0.95% |

| February 2023 | $98.40 | -0.82% |

| March 2023 | $98.51 | 0.44% |

| April 2023 | $96.56 | -1.88% |

Occupancy

Self-storage occupancy rates have declined gradually along with prices, with overall industry occupancy falling 5% from their last peak in July 2022. Compared to a year ago, self-storage occupancy was down 4.62% in April. On a month-to-month basis, occupancy rates took a one basis point hit. Usually occupancy gets a slight bump in April. Combined with the steeper than expected price decline seen last month, the trend may be indicative of muted demand and/or oversupply of units in some markets.

Move in / Move out Rate

In April, move-ins outpaced move-outs at a rate of 1.21 to 1. That rate is fairly consistent with what the industry saw during previous years at this time of year. This suggests that patterns of consumer rental behavior remain consistent and reliable, however overall activity was softer compared to last year when there were 1.25 move-ins for every move out.

| Month | MI/MO Ratio |

| April 2023 | 1.21 |

| April 2022 | 1.25 |

| April 2021 | 1.53 |

| April 2020 | 0.97 |

| April 2019 | 1.19 |

Takeaway

Overall, the latest numbers suggest the self-storage industry is in a good position as it enters the summer busy season. Pricing and occupancy remain above pre-COVID levels, and demand seems in line with historical trends. The true test lies ahead as to how far operators can push pricing in the coming months. Price sensitivity in an inflationary environment poses some challenges to that, however more and more operators are using sophisticated methods to optimize rates in real time to maximize revenue. The wide adoption of revenue management tools allow the industry to drive rates incrementally, potentially closing the gap even when there is slackening in demand trends.